Banks turn cautious on student loans as NPA's rise amid COVID-19 pandemic

With unemployment rising, the ability of those who have taken education loans to pay back has come down sharply. As a result, the non-performing assets (NPAs) have increased in the last one-and-a-half years.

R. Nagarajan took a loan for his engineering course and started repaying it when he got a job at a start-up in the second half of 2019. In a few months, COVID-19 broke out, and the start-up closed, leaving him and seven of his colleagues jobless. “I have not been able to repay the loan for over a year. And now I have a job with a lesser salary and will have to close the loan soon,” he said. With the education loan NPAs rising due to COVID-19, banks are very cautious.

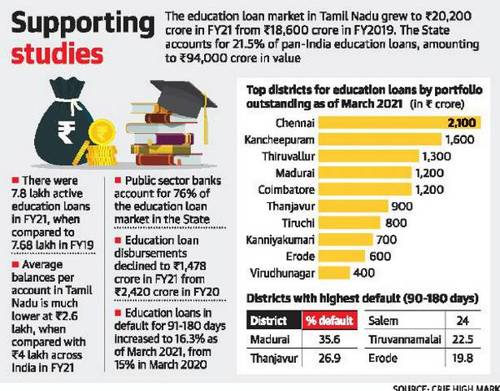

According to data from CRIF High Mark Credit Information Services, the education loan market in Tamil Nadu grew to ₹20,200 crore in March 2021 from ₹18,600 crores in March 2019. The data also showed that education loan NPAs, measured in terms of the portfolio at risk (PAR) for 91-180 days, increased to 16.3% as of March 2021 from 15% at the end of March 2020. PAR is the proportion of loans overdue (for a specific number of days) to the overall outstanding loans.

Education loan NPAs in public sector banks (PSBs) were 7.82 per cent at the end of June 2022, with approximately Rs 80,000 crore in outstanding education loans.

A senior official of the Chennai-based Indian Bank confirmed that the number of education loan NPAs had increased substantially compared with the pre-pandemic period and attributed the increase to unemployment and under-employment. For Indian Bank alone, the education loan NPAs increased about 17.2% to ₹1,197.51 crore as of June 2021 from ₹1,021.1 crore as of September 2020. Even those seeking new education loans find it tough to get sanctions.

Parents of many students whom The Hindu spoke to said that after COVID-19 broke out, banks were reluctant to sanction loans, and some lamented that their reduced salaries did not meet the banks’ requirements. According to the RBI's Report on Trend and Progress of Banking in India 2020-21, the outstanding education loans of all banks totalled Rs 79,056 crore at the end of March 2020 and Rs 78,823 crore in March 2021. However, as of March 25, 2022, the outstanding loans totalled Rs 82,723 crore. But bankers say disbursements were low for several other reasons.

Reduction in demand

The Indian Bank official pointed out that there was a reduction mainly due to the decline in the demand in recent years for engineering education. This constitutes a significant exposure of loans under ₹7.50 lakh.

Most banks offer an education loan scheme based on the Indian Banks' Association (IBA) model to students pursuing higher education. Education loans up to Rs 4 lakh do not require collateral, those up to Rs 7.5 lakh can be obtained with collateral in the form of a suitable third-party guarantee, and education loans above Rs 7.5 lakh require tangible collateral.

Generally, engineering, medical and management courses account for most of the demand for loans. He said the bank had not turned cautious in lending since loans up to ₹7.50 lakh were covered under a credit guarantee scheme. “Tamil Nadu is an important region for education loans as the State accounts for one-third of the total number disbursed in the country,” said Vipul Jain, Head of Products at CRIF High Mark.

Under the Central Sector Interest Subsidy Scheme, the total interest subsidy is provided for the moratorium period (the course period plus one year) on loans of up to ₹7.5 lakhs taken from scheduled banks. The benefits apply to students of the weaker sections with a parental income of up to ₹4.5 lakhs a year.

Some experts pointed out that political parties promising education loan waivers also affect repayment and the CIBIL score of students (the score is a measure of creditworthiness).

Source: Publication:Thehindu,19th July,2021