Compliance due diligence refers to evaluating and assessing the regulatory and legal risks associated with a business relationship with a third-party supplier, vendor, or partner. The goal of compliance due diligence is to ensure that the third party complies with all relevant laws and regulations and that they have adequate measures to prevent and detect illegal or unethical activities.

This blog highlights the significance of compliance due diligence and outlines the steps in the checklist to follow.

In today's global business environment, companies are increasingly exposed to various legal and regulatory risks, including anti-bribery and corruption laws, sanctions regimes, anti-money laundering laws, and data protection regulations. Failure to comply with these laws can result in significant fines, reputational damage, and even criminal liability.

At its core, compliance due diligence is about mitigating risk.

Therefore, it is crucial for parties involved in commercial transactions to conduct comprehensive compliance due diligence. Taking the necessary measures to confirm compliance is essential to mitigate organisational risk and avoid potential liabilities.

Apart from the financial implications incurred from non-compliance consequences, failing to adhere to regulations also incurs an obscured cost - reputational harm.

What Does CRIF Compliance Check Report Cover

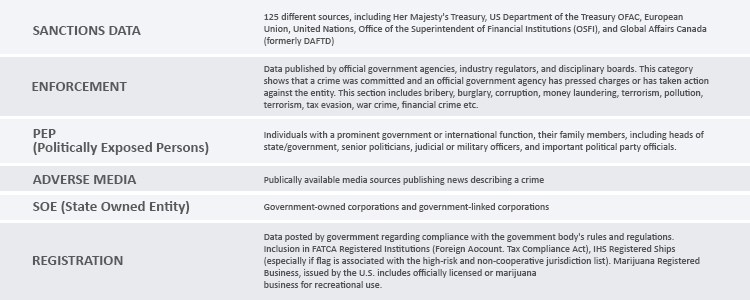

The compliance check offered by CRIF covers several database segments tailored to fit specific financial crime compliance and risk management strategies. These database segments include:

-

Sanction Data

Identification of individuals and companies subject to economic or legal sanctions. -

Enforcement

This examines whether a client has faced enforcement action by regulatory bodies, which may include fines or penalties due to non-compliance. This assists businesses in evaluating the level of risk associated with conducting business with the client. -

Politically Exposed Persons (PEP)

This involves identifying clients who hold a prominent public position or have a relationship with someone who holds such a position. PEPs are considered at higher risk for financial crime and require additional scrutiny. -

Adverse Media

To track media sources for unfavourable information about a client, including criminal involvement or participation in financial scandals. This enables businesses to detect potential reputational hazards linked with engaging in business with the client. -

State-Owned Entities (SOE)

This involves identification of government owned corporations and government linked corporations. Increasing vulnerability of these entities towards illicit practices makes it essential for companies to scrutinize any operations linked to SOEs. -

Registrations under FACTA, MSBs

This checks whether a client is registered under relevant regulations, such as the Foreign Account Tax Compliance Act (FACTA) or Money Services Business (MSB) regulations. These regulations require businesses to identify and report certain types of transactions, and failing to comply can result in penalties and legal repercussions.

By using these tailored database segments, businesses can achieve higher levels of decision precision and reduce the risk of financial crime and non-compliance.

CRIF's Compliance Check Report provide businesses with the information needed to manage compliance risk effectively, make informed decisions, and build trusted relationships with third parties.

With CRIF's compliance check, businesses can easily verify the compliance status of any company worldwide, allowing them to work with new clients confidently and make informed decisions before entering into contracts or engaging in business transactions.

Key Benefits:

Trusted | Global | Comprehensive

Worldwide Availability

The Compliance check report is available for all countries covered by the current SkyMinder offering.

Completeness

Checks are made in all available sources in order to have a complete overview of the subject according to the due diligence approach.

Flexibility

Option to choose the type of subject to check: Company or Individual. To have a clear picture, it is sometimes necessary to extend the number of queries.

Compliance Check: Lists screened for each identified subject and match score, Information details for each identified subject.