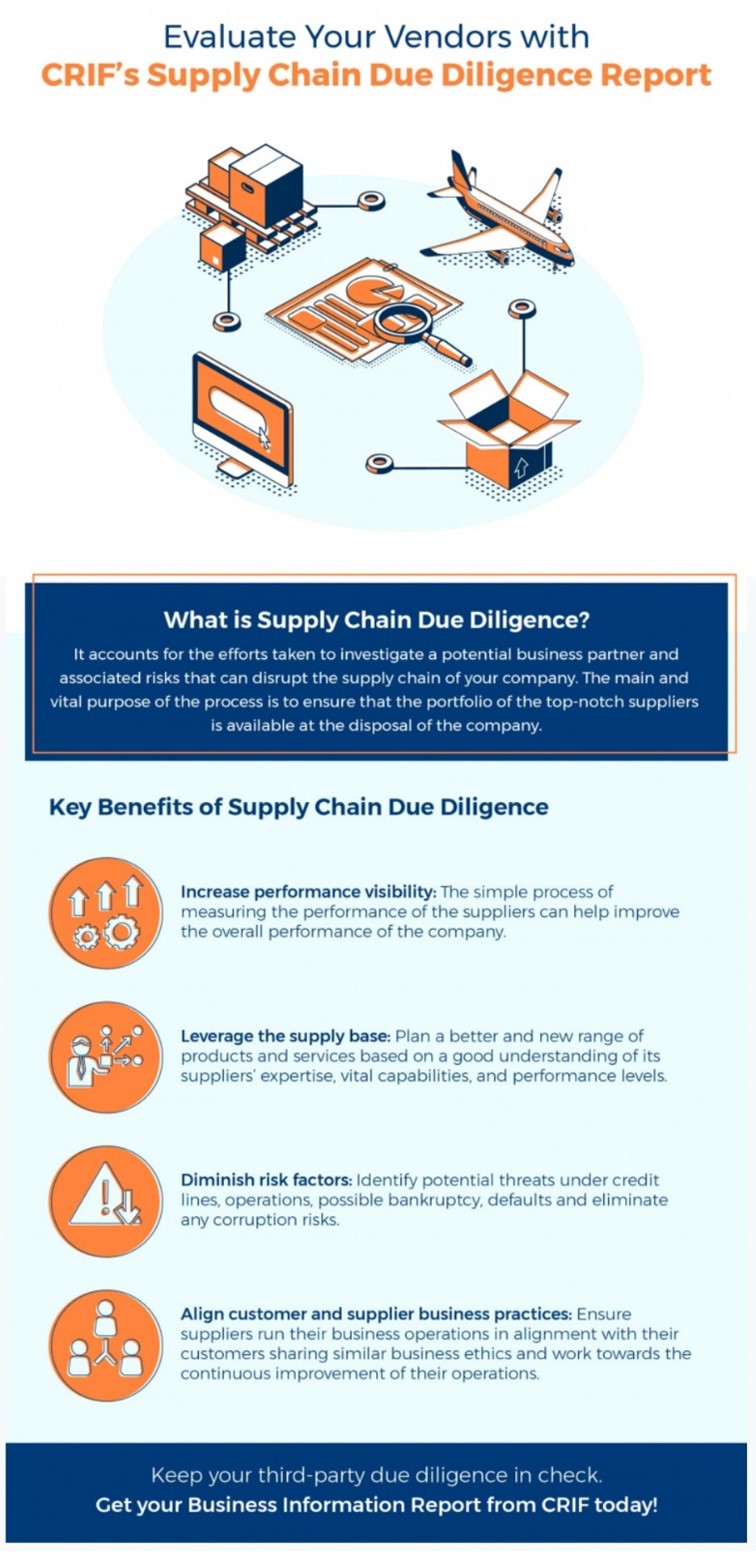

In today’s business ecosystem, businesses are heavily reliant on third-party vendors, subcontractors, and partners for effective vendor risk management and to achieve their strategic goals. Partnering with a third party can boost an organisation's competitive advantage by unifying resources and enhancing expertise, which will lead to unlocking new opportunities, markets as well as clients. However, an organisation could be at risk concomitantly regardless of whether it establishes a new vendor partnership or maintains an existing one. A surefire way of assessing potential risks before they cause irreparable damage to your organisation is by conducting Vendor due diligence before onboarding a vendor.

What Is Vendor Due Diligence Process?

The vendor due diligence process is a careful, methodical and thorough investigation that covers every facet of vendor management, from operational to reputational, finance to compliance, before entering into a business or contract with a vendor.

The most critical element in this process is risk assessment.

Importance and Benefits of vendor due diligence (VDD)

Vendor due diligence involves assessing a vendor's potential risks and vulnerabilities that could adversely affect your business while ensuring compliance with industry best practices.

Conducting vendor due diligence can be beneficial for:

- Identifying potential security risks, such as vulnerabilities in the vendor's IT infrastructure or a lack of incident response plans.

- Assessing compliance with relevant regulations and industry standards, such as data privacy laws and standards, is a best practice for continuous monitoring.

- Evaluating the vendor's overall operational stability, including financial health and management practices.

- Identifying any red flags or warning signs that could indicate a high risk of vendor failure or data breaches.

- Assessing the vendor's reputation risks and ensuring the supplier has the necessary resources and expertise to deliver the committed services is essential for a strong vendor relationship.

- Authenticating that you are not paying for inferior goods or services.

Overall, conducting vendor due diligence is a critical and non-negotiable activity in protecting an organisation's sensitive information and maintaining compliance with relevant regulations and industry standards. It also helps organisations make informed decisions about which vendors to work with and how to manage the relationship effectively.

Protect your business from hidden vendor risks.

Download our comprehensive Vendor Due Diligence Checklist to ensure no critical step is missed.

CRIF's Vendor Due Diligence Report

Vendor Due Diligence Checklist:

Basic Company Information

To ensure that vendors comply with local laws and regulations, collecting basic business information from every prospective vendor is important. This may include the following:

- Vendor's business certificate or license

- Information about the CEO and other executives is vital for a thorough audit of the vendor's background.

- Location

- Incorporation documents

- Overview of the company's corporate structure

Operational Risks

As part of the third-party due diligence process, you must determine whether the vendor under consideration is vulnerable to operational threats that could harm your business. Operational risk should be evaluated by looking for:

- Past litigation and settlements

- Markers of a negative workplace culture in the supply chain

- Employee code of ethics

- Business continuity plan

- Employee retention rates

Third-party Cybersecurity Risks

Third-party data breaches are becoming commonplace and are among the most damaging types of cyberattacks (both reputational and financial). It is important to assess third-party cyber risk by looking for:

- Data breach history

- Compliance reports

- Security awareness test results

- IT system diagrams

- Results of penetration tests

Financial Data

Assessing potential vendors' financial stability and compliance is crucial for comprehensive supplier due diligence process. Establishing a relationship with a vendor who may become financially unstable or non-compliant shortly would be futile and a waste of resources. To ensure that vendors are economically sound, it is important to consider the vendor’s:

- Compensation structure

- Major assets

- Loans and other obligations

- Balance sheets

- Tax documents

Reputational Risks

Vendors with access to sensitive information or systems need to be thoroughly evaluated to prevent potential reputational damage from corruption or political vulnerabilities, which could lead to negative press for the organisation. It is important to assess political and reputational risk by checking the vendor's name against the:

- Watch lists

- Pep (politically exposed persons) lists

- Government reports

- Litigation history

- Negative news/reviews

Rely on Us so You Can Rely on Your Vendor Partner - The CRIF Advantage

CRIF's Vendor Due Diligence service gives your business the insights to conduct due diligence and make informed decisions about working with vendors.

Unmatched Analytic Expertise:

We have 30-plus years of experience providing businesses with credit information and risk management solutions We deeply understand the challenges your business faces when assessing the risks associated with vendors.

Data:

We have access to 200 million businesses in 230 countries, 2 million directors on these companies, and 400+ data points covered, which provide accurate and up-to-date assessments of vendors.

Global Coverage:

We have a presence in over 50 countries, allowing you to easily assess vendors across different regions and countries.

Customisable Solutions:

We offer customisable reports to organisations to meet their specific needs.

Count on Our TAT:

First in the industry at a TAT of less than 48hrs, we streamline our processes to enhance efficiency. Our expertise translates into efficiency in results.

T10,000+ Financial Institutions and 600+ Insurance companies rely on CRIF’s expertise. Reach out to our team for your vendor due diligence report.

Take the Next Step

Don’t let vendor risks derail your business. Contact CRIF to learn how our Vendor Due Diligence Reports can protect your operations and drive growth.